I decided that I should write this article a couple of years ago. Needless to say, I ended up procrastinating a bit before getting to it. In retrospect, that may well have been for the best. My recollection of the writing I did about budgeting and the tracking of personal finances previously was perhaps a bit too ambitious for beginners. I think my plan was to take you immediately to the approach that I was using, forgetting that to get to that point there were lots of small, important steps along the way.

The overriding thought was that I wanted to get you to use some sort of financial tracking software like I use, right off the hop. I now realize that method might not be the best approach for everybody. Starting simply and making incremental improvements or adjustments is probably the best way to do this.

That is not to say that you should begin with pencil and paper activities before leaping into the use of any form of information technology to help you budget and track your expenses. No – I still think that committing to using technology is an important first step, it’s just that I no longer think you really need to begin with some fancy budget and expense tracking application.

The other consideration is that since the purpose of all of this is to better inform where and how you spend your money, I should be helping you to figure out a way to do this while incurring minimal or, in effect, no cost at all. This may be a tall order, but doable I think.

The calendar year 2020 is coming to an end, and 2021 is approaching. There is no better time to start to get on top of your spending.

Why Use Technology at All ?????

OK, buddy, stop right there. Please explain to me why I should start using technology at this point in my life when I think we have been getting along perfectly fine doing what we do for most of our adult lives.

You’re right. You do deserve an explanation as to why I think this is a good thing for you to be doing. If you are currently retired, or about to be retired, you are either in or approaching the phase of life when you really need to understand your spending habits. We all have much less income now than what we had during our prime earning years. It is important that our spending habits reflect that, and that we are not just ploughing along guided by our old practices.

Secondly, we are aging, and the number-crunching and our decision-making abilities are now, or soon will become, less easy and accurate as they once were. Sorry, I’m sure you don’t really want to hear that, but it is a fact of life. We need tools to help us keep performing at peak efficiency.

Above and beyond those general issues, there are many simple and direct benefits to using some form of technology to help you understand where the money has been going.

-

- Cognitive benefit of learning something new – simply going through the process of learning and setting up some form of technology to track your expenses is good for your brain… your cognitive function may be in decline, which may make learning to use the technology difficult – but the use of the technology may help mitigate any cognitive decline you experience. – Catch 22 ??? 🙂

- Track finances over an extended period of time – as you will see, being able to look at your spending habits over an extended period of time will help you develop a much deeper understanding of what is going on

- Allows you to quickly look at the data in a variety of ways – by individual categories, using visually informative graphs, compare month to month spending, ad infinitum.

- Look up old numbers – will allow you to “look back in time” to reference specific expenditures

- Compare different years – improves your ability to see the big picture

- Use to refine your budget – your budgeting ability will improve every year that you do it

- Focuses your spending – hopefully, shows you where you are wasting money; perhaps freeing up money for more important things in retirement like travel

- Saves time – it is faster to have a computer crunch your numbers rather than doing it by hand

- It’s a fun thing to do – remember, you’re retired or soon will be, this is a very productive and fun activity to do when you have lots of spare time

- Retirement and the pandemic – as I have written previously, being retired during the pandemic is the best state to be in; you have lots of time on your hands, so get busy doing something new… that ultimately will be of great benefit to you

A Simple Approach to Start

If you want to leap immediately into using financial software to budget and track expenses, go for it. However, you don’t really need to do that to get going. The simplest thing to do would be to generate a spreadsheet, or small series of spreadsheets, to develop your budget and track your expenses. Although I use Quicken for budgeting and tracking, I still have a few spreadsheets where I track other aspects of our finances (e.g. cash flow, investment analysis, credit card expenditures, etc.).

I wish I could provide a budgeting and tracking spreadsheet for you to download to get you rolling. But I don’t have one. Not to worry, there are a myriad of different free spreadsheets for this purpose already available on the web. You just have to search for them. There are even some templates built into Excel, if that is the spreadsheet application you are currently using. And, there are lots of others developed by finance-based websites.

That said, I am not going to just leave you to search for these on your own. Here’s what I’m going to offer up in terms of what I think might be a good place to begin. It is a budget spreadsheet offered by the Credit Counselling Society. I haven’t fully explored it, so I’m not certain if it will allow you to track your ongoing expenses, but it is certainly worth a look.

If you think you might like to do this in a web-based format, the Government of Canada provides not only a number of great resources, including information on making a budget and sticking to it. Additionally they provide access to an online Budget Planner, and an Excel spreadsheet for at home use, but it is the same one from the Credit Counselling Society of Canada cited above… which in turn was produced by the myMoneyCoach.ca website. The myMoneyCoach.ca website also provides additional information on how to use their Budget Calculator, along with their downloadable spreadsheets for Excel and Open Office… and a separate monthly expense tracking worksheet.

All of these websites are great sources for practical financial advice and resources. Check them out in depth when you have the time.

Doing It for Free

Doing It for Free

Since we are talking about monitoring your spending… which should reduce or illuminate some unnecessary expenses… I think it is important that we attempt to do financial tracking at the most reasonable cost possible. Yes, the use of the online budgeting tool at the government of Canada website is “free”. And, downloadable spreadsheets are “free”. But! You are already incurring costs by having Internet and/or cellular service plans, so you don’t really need to pile costs on to that.

If you use Microsoft Office, so that you have use of Excel, you are incurring a cost to do so. I don’t have a solution for the costs associated with home Internet provision and cellular service, but I do have one to offer up that will get you free Office-like software for your use.

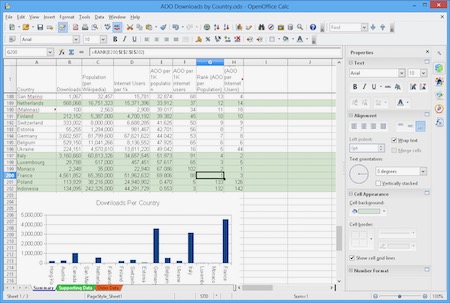

Many years ago, a number of programmers decided that there needed to be an alternative to Microsoft Office that could be made available to the whole world for “free”. And they succeeded. The application “Open Office” is now widely used by individuals and organizations in place of Microsoft Office. It offers a full range of applications, including a spreadsheet, just like the Microsoft version.

Even more interesting, is that some of the developers working on Open Office decided they wanted to go off in a different direction… ostensibly to build a better product I assume… and so they did. They’re offering is called “Libre Office”. Both are free downloads, AND both allow you to open Excel files and save as Excel files if you so desire.

It should also be noted that a number of Canadian banks allow you to budget and track your expenses. If you are into online banking, Royal Bank and CIBC are two that immediately come to mind. You can check out their offerings by following the links I have provided. Always remember, if a business is allowing you to track your spending, they are probably doing it for their benefit, not yours.

If you think you can skip over the spreadsheet methodology, then let’s dive down into the various financial tracking applications available. Let’s begin with the oldest, and the one that I currently use, Quicken.

In the Beginning… Quicken

Quicken is pretty much still the top dog in the software group. It was one of the originals and has outlasted others like Microsoft’s “Money” to become the gold standard for the rest. This doesn’t necessarily mean that it is the best, just the most widely used. It is the one that I use, but at this point that may simply be because I am married to it historically. It works, and it works for me, so that is all I will worry about.

And what it does for me is that it allows me to create a budget before I start each fiscal year based upon the categories of expenses and income that I track. And, it allows me to track all of my spending in great detail so that I see where all the money is going and have my actual spending compares to the budget. I have been doing this for so long now that my budgeting has become very, very accurate. This has contributed mightily to our financial planning, spending behaviours, and financial progress before and after retirement.

If you are interested in finding out more about Quicken, I am going to suggest that you read the material provided by them on their website. It will give you a better overview than what I am capable of providing for you. They offer a 30-day cancellation policy if you would like to try it out before fully committing. Pricewise, you can pay as little as $39.99 a year for their basic application, up to $94.99 a year for their home and business application if you are operating a small business along with managing your family money. (The home and business application does not appear to be available for Mac users). I use their Mac Deluxe application.

I suppose one of the reasons I stay with Quicken rather than trying out some of the others that are now available, is that you actually get to download an application and use it on your home computer. As you will see, some others have you store all of your information in the cloud, i.e. upload it. I am not terribly keen on having our financial information sitting on someone else’s file server where it could be subject to hacking.

That said, the version of Quicken I am currently using does ultimately upload everything into the cloud so that you can access it, or enter information, from your mobile devices. I guess what I’m really not keen on is the thought of my information being solely stored in the cloud where it could be lost forever if someone’s file server gets fried.

All the Rest

All the Rest

Back when I started using Quicken, the choice was either it or Microsoft “Money”. Things have changed. There is now a proliferation of budget and tracking software available – so much so that it would be difficult to decide which one to use. Of course, many of these are exclusively mobile device apps that allow you to track your expenses on the fly.

If you Google search for applications in this group, you will come up with a multitude of “top 10” lists extolling the virtues, or lack thereof, of a whole range of products. I am not going to suggest you do that because it is time consuming and they probably won’t move you further ahead in your decision-making process.

The research that I did led me to discover that there are two apps, other than Quicken, that constantly appear as good choices. Those are, “Mint” and “YNAB” (You Need A Budget). “Mint” is owned and operated by “Intuit”, the company who created Quicken before they spun it off as a separate company. So, one would assume these guys know what they’re doing when it comes to developing financial software. It appears that “Mint” is totally web-based, and free… allegedly.

“YNAB” offers a downloadable application for your desktop if you prefer going that route rather than having it all web-based. That said, I wasn’t able to confirm the existence of their desktop application when I went through their site. You probably have to sign up before you can gain access. As with “Mint”, you can sync your information with all of your mobile devices. “YNAB” is not free, $84.00 per year… US dollars I am thinking.

If you are looking for a comparative analysis of these two options, here are links to a couple of articles I found on the investorjunkie.com and millennialmoneyman.com sites by doing a quick search. I am sure there are others. Reading these should provide you with a general understanding of the similarities and the differences between the two. Individual reviews of both products are widely available as well. Both are available for use in Canada.

Categories to Budget For and Track

The very first step in all of this is that you have to identify what the categories and related sub-categories are that you are going to budget for and begin tracking. If you want a place to start thinking about what categories you might use, you can read my post from a couple of years ago that itemizes all of the categories that we track.

Two years down the line, I would say the above with a bit of a caveat. We worked our way up to this number of categories… and especially, subcategories… over time. It might be best for you to start with fewer, so that you don’t get frustrated by the amount of detail involved and quit doing it. Remember, many of ours will not apply to your situation, and there are others specific to you that we would have no need to track, but you will.

Enter 2021 Prepared to Understand Your Spending

Enter 2021 Prepared to Understand Your Spending

So, there you have it, a number of options, web-based and hardware-based – whatever your preferred method would be. And, just to repeat what I said at the beginning, it is now the end of 2020 and we are rapidly approaching the beginning of 2021. This is the ideal time to start budgeting and getting geared up to track your spending in 2021. I would love to hear how that turns out for you.