“Axe the tax.” I’m not sure how many hundreds of times we’ve seen-read-heard this statement in the last couple of years. Pierre Poilievre and the Conservative Party of Canada have gone slogan crazy, and this is their favourite one. And now that an election is rapidly approaching, I’m sure we’re going to hear it several more hundred times.

I think it’s time to step back and just revisit what the noise is all about. And this is going to require me to make a bit of a personal declaration. For the record… I am a bit of a political… Agnostic. So, as the saying goes, I don’t really have any political skin in this game.

I literally have voted at one point or another for all three of the major political parties in Canada. So, I am not a card-carrying member of anything. I am very much a centrist politically, which I guess, would explain why I have no issues voting either left or right based upon what I consider to be local, provincial, or federal needs at the time.

I mention this because the “carbon pricing/tax thingy” really has become totally political. Unfortunately. The net result is that there are many opinions being vigorously expressed both for and against the policy, and things are on a bit of a collision course.

I hope to take an unbiased look at the issue.

Title image – from the “Institute for Research on Public Policy”

Why Now?

I will have to admit that before I decided to drill down into this a bit, like most Canadians, I was very vague about the specifics of the program. I finally decided that it was time to get myself informed and perhaps share what I found out with you. The only thing that really garnered my attention was that four times a year $210 is now deposited into our bank account as a rebate. This did not offend me in anyway and never caused me to start chanting “axe the tax”. 🙂

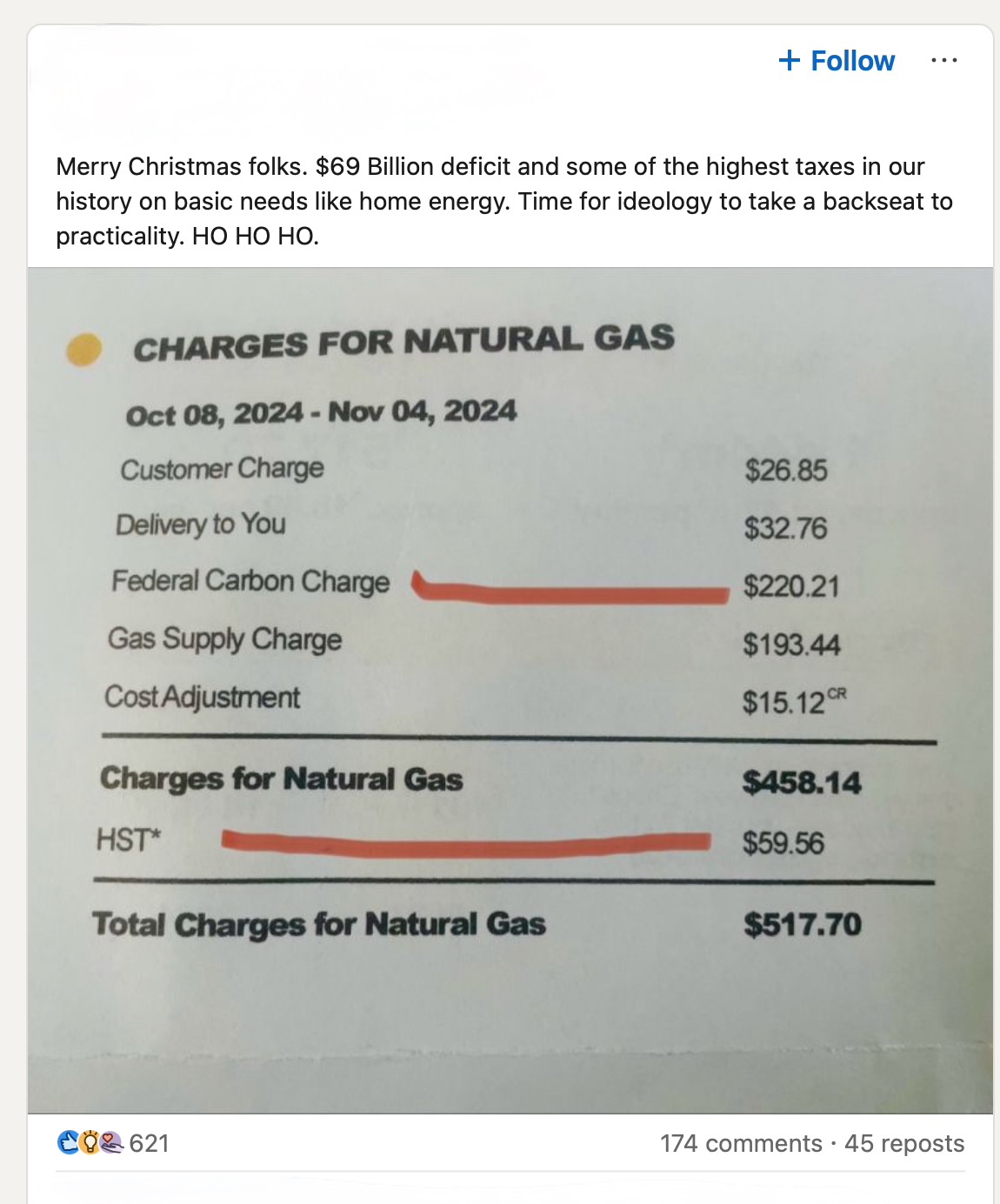

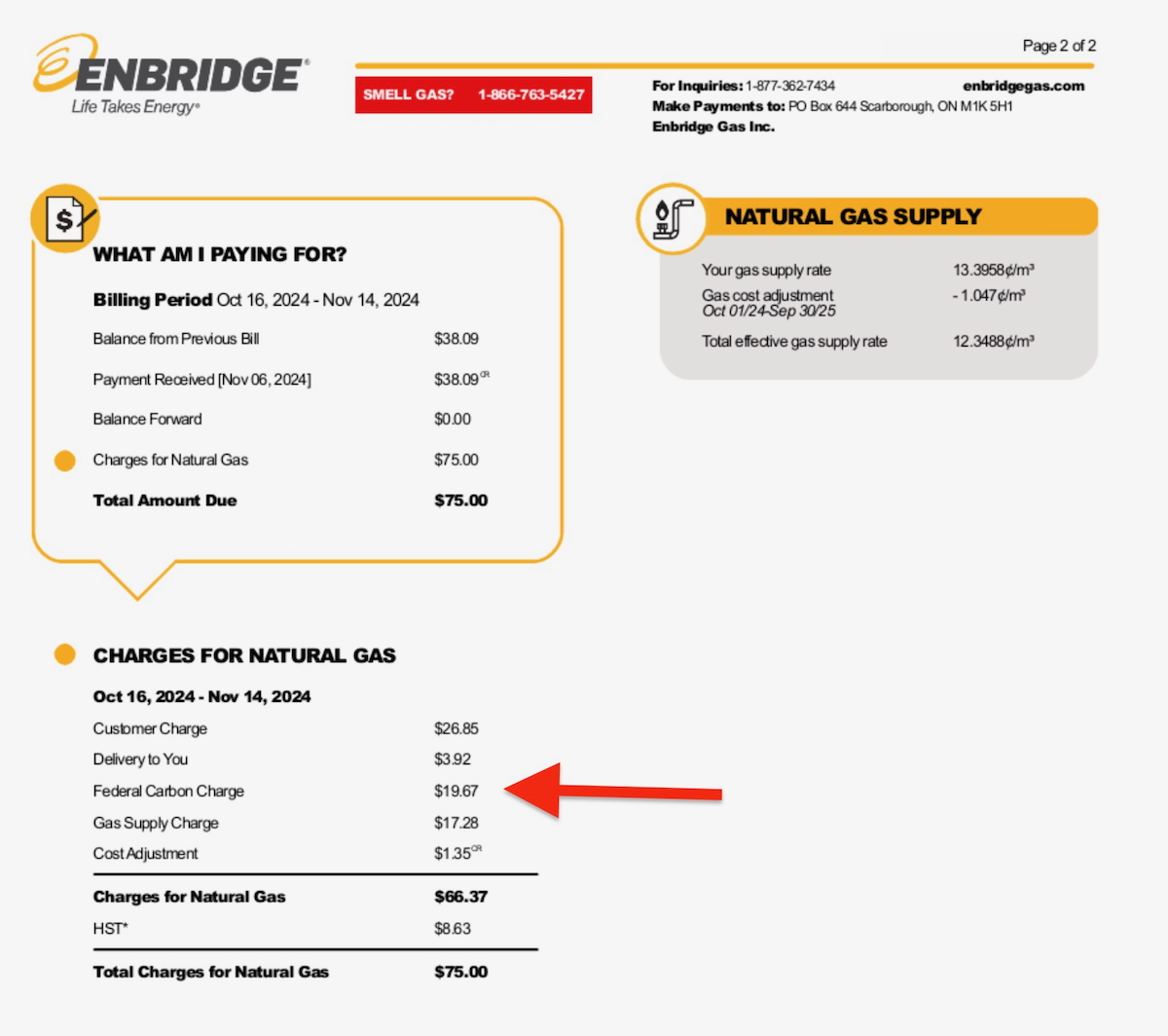

The other thing that got me thinking about all of this was a favourite neighbour, who is “right leaning”, sent me an email with an image of a post on LinkedIn by a local businessman, who was expressing some distress over the “Federal Carbon Charge” that had appeared on his gas heating bill. He also pointed out that we are paying HST on top of the carbon pricing. This is certainly true, but I think it needs to be pointed out that most of those funds were being scooped off by the provincial government, not the feds. This all got me thinking that I could check our gas bill too and find out what our “Federal Carbon Charge” was as well.

Considering that the gentleman posted this in a public form, I don’t think he will probably mind me sharing it here given that it contains no identifying information.. I will be sharing my own bill as well. It’s easier to compare these two because we live in the same community and are being billed by the same gas company. For the record, his post garnered much discussion with opinions on both sides being expressed.

Let me share the two images of his and our gas bill for a roughly similar time. My first thought when I saw the two together was that this guy must live in an enormous home, not a small urban townhouse like we do because they appear to have used approximately 11 times more gas than we did over a similar period. :-)That said, the “Federal Carbon Charge” for both houses were proportionally similar. My second thought was… Geez, the breakdown of the charges on our gas bills seems terribly convoluted. 🙂

That all said, I suppose my goal here is to figure out what the carbon pricing was meant to do, what it really means for consumers like me and you and, hopefully figure out whether I think this is a good, bad, or indifferent policy.

What Is It Supposed to Do?

I suppose a good place to begin is go right back to the beginning and see what climate pricing was supposed to do. When I Google searched the subject matter the first thing came up was the Government of Canada official webpage on the program and other sites, primarily environmental sites like the David Suzuki organization that stated what the expected benefits would be.

The government of Canada statement seemed pretty vague, and the David Suzuki site was certainly vigorously espousing the benefits. So, I went in search of something a little more specific, less biased, and quite honestly more concise.

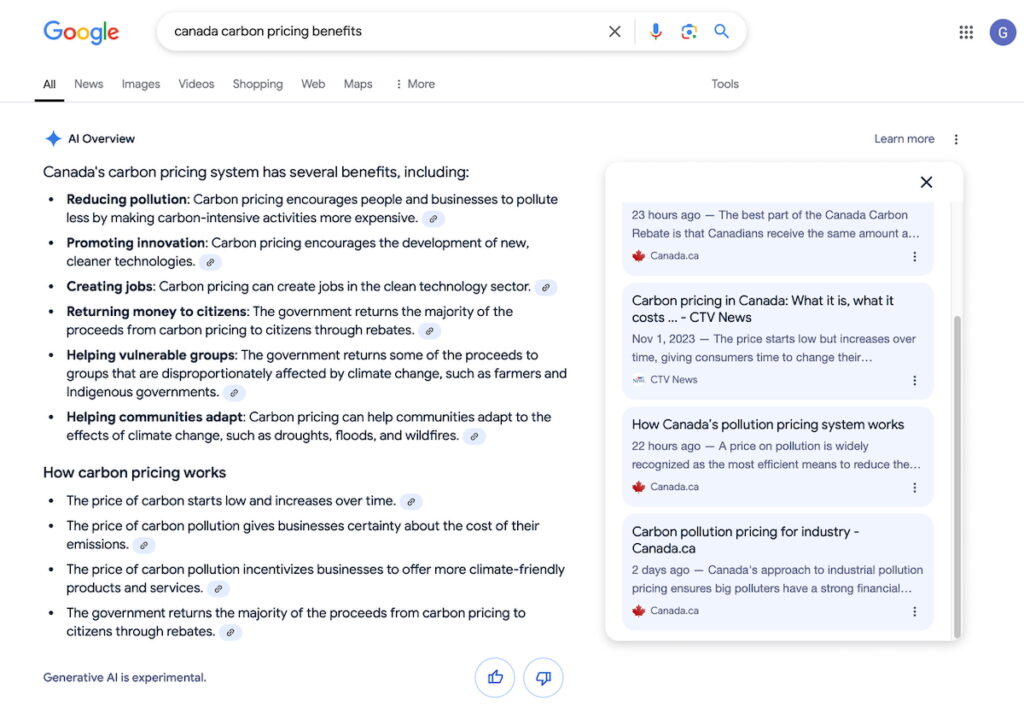

To my surprise… I certainly shouldn’t have been surprised I suppose… but my next more specific Google search included a Google Artificial Intelligence generated response. And that is what I am going to use to set up what the benefits of a carbon pricing program should be. The Google AI answer matched what I had read elsewhere and supplied a list of references to its sources. And, quite honestly, the concise summation it came up with was exactly the sort of thing I was hoping to get. So here it is in all its glory, for better or for worse.

“AI Overview

Canada’s carbon pricing system has several benefits, including:

• Reducing pollution: Carbon pricing encourages people and businesses to pollute less by making carbon-intensive activities more expensive.

• Promoting innovation: Carbon pricing encourages the development of new, cleaner technologies.

• Creating jobs: Carbon pricing can create jobs in the clean technology sector.

• Returning money to citizens: The government returns the majority of the proceeds from carbon pricing to citizens through rebates.

• Helping vulnerable groups: The government returns some of the proceeds to groups that are disproportionately affected by climate change, such as farmers and Indigenous governments.

• Helping communities adapt: Carbon pricing can help communities adapt to the effects of climate change, such as droughts, floods, and wildfires.

How carbon pricing works

• The price of carbon starts low and increases over time.

• The price of carbon pollution gives businesses certainty about the cost of their emissions.

• The price of carbon pollution incentivizes businesses to offer more climate-friendly products and services.

• The government returns the majority of the proceeds from carbon pricing to citizens through rebates.

Generative AI is experimental”

I didn’t specifically search out the pros and cons for the program because at this point, I think everybody in Canada has already formed an opinion about whether it’s good or bad are not going to be swayed by anything that I can share here. This really will be more of a “postmortem”. 🙂

What I was surprised to discover though, was a quote in Wikipedia attributed to Rex Tillerson, the former CEO of Exxon mobile which was a bit of a backhanded compliment.

Here it is…

“On December 11, 2008, ExxonMobil CEO Rex Tillerson said that a carbon tax is preferable to a cap-and-trade program which “inevitably introduces unnecessary cost and complexity”. A carbon tax is “a more direct, more transparent and more effective approach”. Tillerson added that he hoped that the revenues from a carbon tax would be used to lower other taxes so as to be revenue neutral.”

Other Things You Need to Know

There are a couple of things that you need to know about the program that may have been unknown to you at this point. Number one is that not all provinces and territories participate. Those that do are Manitoba, Nunavut, Prince Edward Island, Yukon, Alberta, New Brunswick, Newfoundland, and Labrador, Nova Scotia, Ontario, and Saskatchewan.

Not participating are British Columbia, the Northwest Territories and Quebec. All three of those have their own carbon pricing/capping trade system that they use already. Their systems either meet or exceed the federal benchmark criteria.

Secondly, there are actually two systems for pricing carbon in Canada. The fuel charge applied to consumers, and another system applied to industrial emitters (OBPS).

The other important, generally unknown fact about carbon pricing is that it is meant to be “revenue neutral” i.e. not a money maker. Most of the money collected from the federal carbon pricing program is returned to Canadians households in the form of a quarterly payment. Approximately 90% of the revenue generated is to go directly back to Canadian residents, with the remainder, going to support small businesses, schools, hospitals, and indigenous communities.

There are others as well, but to avoid getting lost in the weeds, let’s move ahead.

Is It Actually Doing What It Is Purported To Do?

Because a program like this is designed to provide long-term benefits, the benefits it has provided in its first few years of operation have not been detailed with any real clarity at this point. I would suggest if you were interested in this piece of the equation then read these two linked articles I found from the CBC News and from CTV news. Both primarily focused on the generalities of the program but do make some statements about its effectiveness.

What I think you need to know about the effectiveness of the program as it is known is stated below in this quote from the CBC article.

“The federal government has estimated that all carbon pricing will account for up to one-third of Canada’s emissions reductions in 2030.

Most of that one-third will come from the industrial pricing, which is far more effective according to a new study by the Canadian Climate Institute.

The researchers found that the carbon pricing applied to big industrial polluters will cut between 53 million and 90 million tonnes by 2030, while the pricing on consumers will cut between 19 million and 22 million tonnes.”

Make of that what you will. At this point, I am more interested in what the immediate financial considerations are for Canadians.

What’s In a Name?

Here is a situation where that phrase “what’s in a name” really has some meaning. The formal name given to the program really isn’t that important to know but it is officially referred to as “carbon pricing”, whereas most people now refer to it as the “carbon tax”. And obviously, there is lots of angst and good old-fashioned politics imbued in all of that.

I am not here to tell you what you should choose to call the program. So, feel free to refer to it in whichever way you prefer.

The Difference Between “Carbon Pricing” and “Taxes”.

That said, I think it would be important to state the difference between what taxes are and do, and what carbon pricing is and does as well. The taxes we pay to governments of all levels are used to provide citizens with indirect benefits or paybacks, including:

Healthcare, national defense, public safety (e.g. law enforcement, social programs), child benefits, infrastructure (e.g. transportation structures like roads and bridges), education, public transit, emergency services, waste management, and a myriad of other amenities provided in a capitalistic democracy.

Carbon pricing on the other hand is more akin to borrowing money from citizens and then more directly returning it in quarterly cash payments to individuals and families, and some organizations like small businesses.

Our Rebate/Our Cost

And that really brings me to the gist of what I want to do here, namely find out if what we are paying in carbon pricing is being fully returned to the Love-goddess and me in those quarterly payments. 🙂

After giving it a lot of thought, I am fairly certain that the only “fuel products” that we use are gas to cook and heat our house and gasoline for the car. We don’t even buy propane for our barbeque anymore because we have a direct gas line to it. This makes it much easier for me to calculate how much carbon pricing we are charged in an average month.

And that has how I am going to approach this; do my calculations based upon an average month. I do this because the original gas bill that precipitated this little discussion accounted for one month span over October and November. I will try hard to make my calculations mostly focus on that span over the month of October and November as well. And I will certainly err to the upside in an effort to not undervalue how much carbon pricing we paid.

Let’s get after some number crunching! First up, the rebate portion

Carbon Rebate

That is very straightforward. We receive a rebate of $210 every three months, so that exactly averages out to…

Rebate – $210 for three months or $70 per month/30 days.

Carbon Pricing for Car

Figuring out how much I have paid in carbon pricing on the gas we have used in our car is a little bit more difficult. That said, not impossible. There is enough data available out there to come up with a pretty close approximation for what it would’ve been in a 30-day period spanning October and November in 2024. Here are the calculations.

I don’t know how many litres of gas we bought, but I know exactly how much money we spent on gas for the car in 2024, $2958.19. That works out to be an average $246.52 per month.

This is one of those great situations in which that old axiom applies… “Statistics don’t lie, but statisticians do”. 🙂 I say that because my per month calculation would have made sense to everybody, so would not have been questioned, but it was not factually correct. We are in Spain for two months every winter, we really only buy gasoline during 10 months of the year so that more accurately works out to us spending $295.82 per month on gasoline.

The numbers $2958.19 ÷10 = $295.82 per month

The next thing I had to calculate was what was the average price per litre for gas in our area over that period that span October and November of last year. Thank goodness, we have tools like ChatGPT to track down that information and do the calculations for us in a matter of seconds so it is not necessary to spend lots of time tracking it down.

According to ChatGPT, the average price of gas in the area in which we live was 152.65 cents/litre over the study period. Expressing that in dollars and cents, which presents it in a format, we are more used to, the amount is $1.5265. And yes, all these calculations will have to be done to four decimal places because that is how the carbon pricing is done. And for the sake of accuracy, I am not going to round those numbers to make it look more standard (e.g. $1.53).

So, $295.82 ÷ $1.5265 = 193.79 litres purchased

Next, we must multiply the number of litres purchased by the carbon price per liter, which during October and November of last year was 17.61 cents per litre, or $0.1761

So, finally 193.79 litres x $0.1761 per litre = $34.12 paid in carbon pricing

After all that, we estimate that we paid approximately $34.12 in carbon pricing for gasoline in a month-long period that spanned October and November.

Carbon Pricing for House

No calculations are required because our gas bill indicated that we had paid $19.67 in carbon pricing during that period.

Carbon Pricing Grand Total

Total carbon pricing paid $34.12 + $19.67 = $53.79.

It is clear that the process of paying carbon pricing and then receiving a rebate is working out positively for us. So, there is a reasonable chance that this is the same for many Canadian families. I say that acknowledging that some people are spending large amounts on gas for vehicles and for heating their home and may not be breaking even. But I suppose that’s the price you pay for being a very large consumer of those fuel sources.

So, after having gone through the process of comparing our costs with our rebate and thinking about what the plan is supposed to do, I would have to say that I now think it was generally a good concept, and perhaps one that should have been embraced by the majority of Canadians. That has not happened for sure. Let’s talk about why not.

How We Ended Up Here … Bad marketing

When I tap into my marketing experience from decades ago, it is obvious to me that the government did an incredibly bad job of marketing the program. Even I, who pays attention to these sorts of things, really did have to go back and revisit the program and our cost and refund to clearly understand that this was beneficial to us. All Canadians should have been helped to understand that very clearly from when the program started.

They should have been shouting “Yes, you are going to be paying more at the pump for your gas, and more on your heating bill, but you are going to get that money back in lump payments every three months. And many of you will even receive back more than what you pay in!”

If you would like a simple example of one of the marketing missteps, here’s a very simple straightforward one. When we began to get our rebates, it was referred to as a “Climate Action Incentive Payment”… what the hell does that mean? The government has corrected that and now make it clear that we are receiving the “Canada Carbon Rebate”… DUH! There was no direct link between what we were paying, and the understanding that we are getting that same money handed back to us.

The second consideration is that perhaps it was invoked at absolutely the wrong time… I would have to say that the blame cannot be pinned on the government for that one though. Having yet another added cost put on top of soaring inflation for just about everything else in life during the pandemic made the increase in fuel prices even more noticeable… And probably painful for many people. So, generally, a decent idea launched at the wrong time and poorly presented to Canadians.

Carbon pricing is sitting so poorly with many Canadians that even the Liberal leadership hopefuls who are entering the race as I write this are talking about eliminating the consumer portion of the program at the very least.

Next Steps

When I say, “next steps”, I don’t mean what will happen with the program because it’s very clear that a major change, no matter who gets elected, will take place in the very near future. I’m talking about next steps for me. I’ve decided I’m going to delve down into this a little further and figure out precisely… Or as close to precisely as I can… what we paid in carbon pricing for all of 2024 and compare that to the rebate premiums we received.

I probably will not report back to you on that… But I may. 🙂

That’s it. That’s all. As Ernie Westgate used to stay, “happy motoring”. There’s some very serious “gas” related Canadian trivia for you to wrap things up. 🙂

*Addendum:

For your interest I am just gonna throw out here what ChatGPT said specifically about the calculation of average gas prices. If you are ChatGPT or AI curious this may be of interest to you. If not, just ignore it. 🙂 Added to that I have thrown in a screenshot of what came up in the Google search I quoted above. Look for this AI feature in your own Google searches in future.

From ChatGPT:

“To calculate the average daily price of gasoline in the area in which we live for October and November 2024, we would need daily price data. Since the available data only provides the high and low prices for each month, we can estimate the average by taking the midpoint of the high and low prices for each month:

October 2024:

• High: 157.9 cents/litre

• Low: 145.9 cents/litre

• Estimated Average: (157.9 + 145.9) / 2 = 151.9 cents/litre

November 2024:

• High: 155.9 cents/litre

• Low: 150.9 cents/litre

• Estimated Average: (155.9 + 150.9) / 2 = 153.4 cents/litre

Overall Average (October and November 2024):

(151.9 + 153.4) / 2 = 152.65 cents/litre

Estimated average daily price for October and November 2024 in your area: 152.65 cents/litre.

For precise daily data, additional local records or a detailed source would be required.

Therefore, during October and November 2024, gasoline prices in Ontario averaged between approximately 151.5 and 173 cents per litre, depending on the specific location and data source. “

From Google: