After restating what the OAS “problem” is once again, it’s time to check out a real-life example and then delve into the fun stuff … guilt free and tax-free money … my proposed OAS Plan, and the bribe I am suggesting could be offered up to the folks who are opposed to changing the Old Age Security Recovery Tax program!

A Real-Life Example

You may be thinking:

“Suggesting that some retirees probably shouldn’t be receiving as much in OAS as they do, sounds all well and good in theory, but how is the current system working out here in the real world.”

I agree, I always prefer to provide authentic examples where possible. And in this case, I can provide a very authentic real-life example of how OAS claw-back has impacted a retired couple known to the Love-goddess and myself. In keeping with Globe and Mail’s FINANCIAL FACELIFT format; in an attempt to protect the couple’s identity, let’s call them “Dick and Jane” … a solid Boomer childhood reference. 🙂

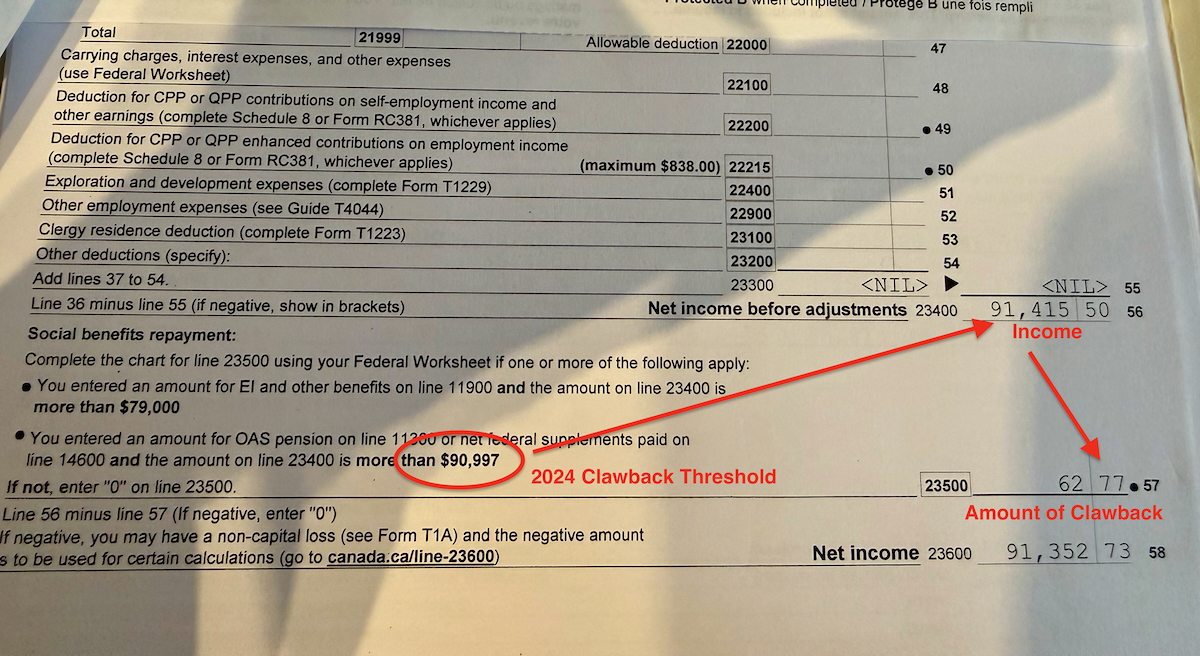

The two images below photos are of Dick and Jane’s income tax returns for income tax year 2024. If you follow the red arrows in the first photo, you track the path from the stated amount for the commencement of OAS claw-back that year, up to their individual net incomes, then follow an arrow down to the amount of money each had clawed back.

As you can see, they had a combined total taxable household income of $182,661.89, from which they had a TINY combined amount of $100.18 clawed back… chump change, a trifling amount, chicken feed, a pittance! Not good!

We do not agree on all things, but the Love-goddess and I agree that at that high level of retirement income no one should be receiving any OAS payments at all – especially when some lower-income seniors and younger Canadians are in need of support. So, we consider Dick and Jane’s having only had $100.18 clawed back by the recovery tax a ludicrous and embarrassing amount. Fortunately, Dick and Jane agree with us and are as bothered by this as we are.

The Amazing Source of TAX-FREE INCOME!

With Dick and Jane’s taxable income all sorted out, the other thing to consider is that their taxable income doesn’t include the tax-free income they made in 2024!

“You can have tax-free income?”

Oh yeah!

“Buddy, if by tax-free income, you mean the five hundred bucks I get from my ‘cash back’ credit card, that small amount is not going to inspire me to willingly give up my OAS income”

That’s not what I’m talking about. What I’m talking about are TFSAs, which are an amazing source of tax-free new income in retirement. Now, it might just be that I keep missing things, but I usually don’t hear sources in the media discussing the important role our TFSA’s can play in our retirement finances. It’s a bit of a head scratcher.

Not only am I not reading enough about it in retirement finance-related columns, but I am also honestly worried that retirees in Canada are not using this incredible tool to its full advantage.

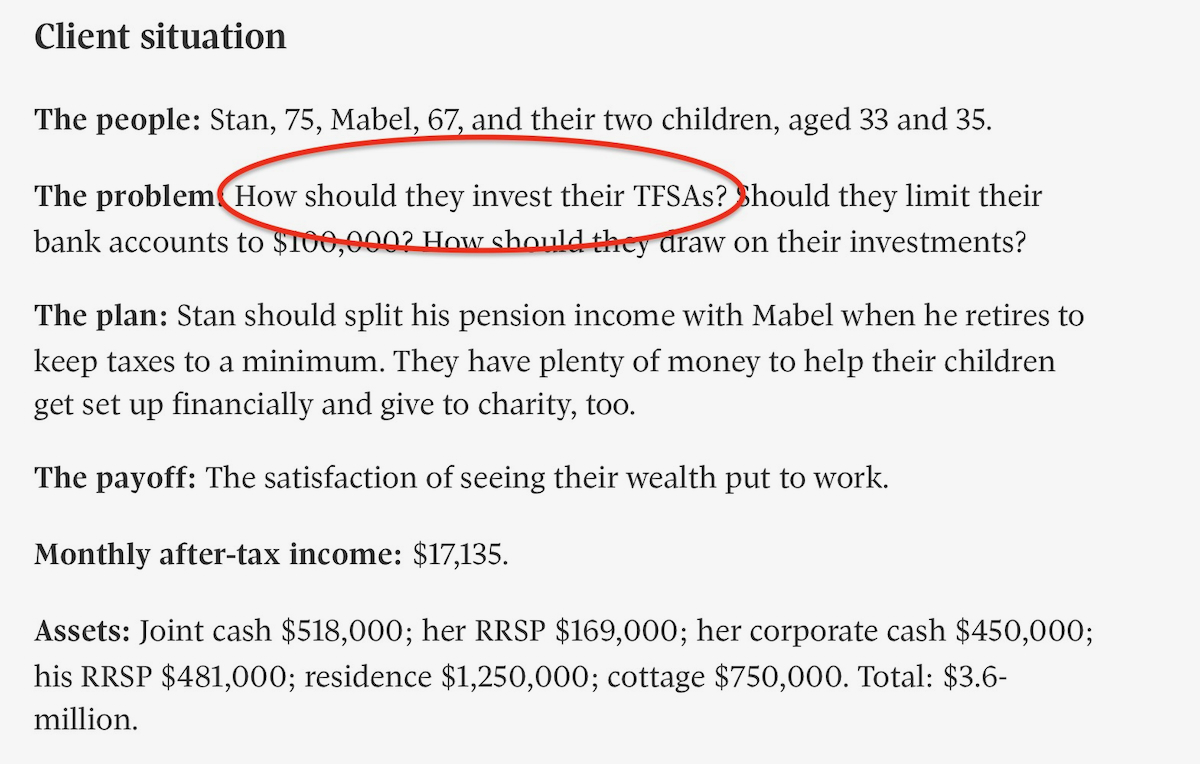

Here are a couple of examples of what I mean. They are from retired individuals who wrote into the Globe and Mail’s FINANCIAL FACELIFT column looking for financial guidance. The photos provide the Globe and Mail’s accounting of their financial assets and situations stated in each article. Follow the links in the names to read the original articles. I was struck by how both of these examples really were not using their TFSAs to their full potential … in one case not at all. And these are affluent folks.

Couple/Photo #1 – Stan, 75, and Mabel, 67 have $3.6-million in assets and have recently figured out that it’s time to start putting some of their money into TFSAs… which they don’t have yet … REALLY???

Individual/Photo#2 – Jodi, 74 has $4,812,000 in assets, including $2,366,000 in non-registered stocks, but she only has $60,000 in a TFSA????

Sitting here scratching my head!

Our TFSAs have grown to become a very important and integral part of our retirement finances. The equity investments we hold there keep spitting out tax-free income for us every year. And that tax-free money now exceeds what we receive in OAS. If you are able, you can still contribute the maximum allowed each year ($7000), even in retirement. It is OK to still be saving a little bit of money each year in retirement, especially if it starts generating new income immediately.

There is a simple path to new tax-free money folks, your TFSAs. Don’t lose sleep over losing your OAS handout.

My OAS Restructuring Plan

The first time I wrote about the need to do something about OAS I threw out a simple plan on how to restructure it right at the end of my piece without giving it a whole lot of thought. But, it was the germination of the idea. I realized that if I was going to harp on about changing OAS, I was going to have to offer up an alternative – even if it only serves as a departure point for discussion. That germination of an idea has expanded to include a form of compensation for the folks who were counting on receiving OAS and would now face losing it.

Here is What I Think We Should Be Doing

To start with, I agree with Dr. Kershaw that the level at which claw-back begins should be raised to $100,000 …. in total household income, not individual income – and that all additional actions should be taken linked to household income. This reduces the harm to single person households and eliminates the ability for two person households to game the Recovery Tax system. For the record, Statistic Canada refers to two person/one person households as, “economic families and persons not in an economic family”.

I also agree with Dr. Kershaw that when reaching the $100,000 threshold, a lump sum should be taxed back rather than a tiny trickle like current claw-back individuals experience. However, I don’t think it should be a fixed lump sum like the $3200 that his group is proposing.

It would not be Generation Squeeze’s intention, but there is an inequity built into that. For anyone who has waited until 70 to take their OAS, the $3200 deduction is a much smaller percentage of the amount of OAS they are receiving than for those who started at age 65. And, I think it’s safe to assume that anyone who started at age 65 probably needed that money more than someone who waited until age 70.

What I am proposing is that the claw-back lump sum be a percentage of what the household is receiving from OAS, as reported in their last year’s income tax filing. And I would suggest that that percentage be a third (33.33%) of total household OAS received.

Practically, for each individual in the household the Recovery Tax claw-back would be an amount proportional to what they received. But again, this is not to be a simple one off. As household income increases, additional claw-backs should take place, again in lump sums.

When household income gets to $125,000/$150,00 (I am not married to any particular amount – That should be decided upon by the CRA), I see another third of the original OAS amount being clawed back. And when income hits $150,000/$200,00 the final third of the original amount and any accumulated cost of living increases would be clawed back.

The Bribe!

There is a good chance this is what you have all been waiting to read about. 🙂 The political bribe is a time-honoured tradition. Currently Donald Trump is thinking about giving away a couple thousand dollars to Americans – and Monsieur Trudeau “the younger” gave most Canadians the “Working Canadians Rebate,” a $250 freebie. And earlier this year Ontario Premier Doug Ford’s government provided many Ontarians with a one-time $200 taxpayer rebate per eligible adult and child.

Yes, I am being facetious, but it wouldn’t be a bad idea to offer an incentive to folks who are about to be subjected to a reshuffling of their retirement finances. So, in truth, what I think should be offered up is more of an incentive than a bribe. Sadly though, you would not immediately be getting any more money in your jeans’ pockets.

What I am proposing is that when you cross each of the financial thresholds where you will lose a lump sum of your OAS, you will be allowed to contribute that same amount (e.g. $8,881.08 x.33% = $2,930.76) to your TFSA on top of the annual amount (currently $7,000). For example, an individual crossing the first threshold would be able to contribute $9,930.76. Anyone who loses all their OAS in this scenario would be able to contribute an additional $8,881.08. But no actual money is being handed out … A bit of a victimless crime.

I am thinking anyone in the 2.6 % group of people who are already loosing all their OAS money would be thrilled to receive that little perk. And likely, many, if not most, of the folks already losing some of their OAS monies to claw-back would also be pleased.

A very rough outline of a possible solution. Think about it.

Note: ChatGPT – most of the images used in this two part series were created, using ChatGPT with only verbal instruction